PERSONAL RETIREMENT: THE IMPORTANCE OF SAVING EARLY

Aimee McIntosh, Sr. Director, Project Management Office

If there is one thing that I wish I learned much earlier than I did, it is how I should have started saving earlier for retirement. Schools don’t generally teach us about personal finances. It wasn’t until my early 30’s that I had the opportunity to sign up for a 401k and even then thought, “I don’t have extra money to put away”. Nevertheless, I did start saving the little bit that I could afford, but it was years later before I understood how important that decision was and how it would have been even better if I’d started earlier.

A Marathon, Not a Sprint

Most of us won’t achieve huge financial success like Elon Musk or Jeff Bezos. We don’t wake up every morning a million dollars richer. Instead, we should be taking a longer path of increasing our wealth, even if meager, like it is a marathon – not a sprint. You don’t just go out and run a marathon. You train, have patience, and run a little every day to build strength. Think of your money this way: things add up!

If you are young, you don’t need to make a lot of money to end up comfortable later in life. You just need to save as much as you can early on, because you can never catch up if you start older. It is never too late to start, but I wish I had started at 18. In my 20’s, working in restaurants, I rarely had health insurance – so I know how hard this can be. Even if you save only 1% to 5% of your paycheck, it makes a difference. Everyone can save money to create wealth, even if it is not a lot.

Time and Compounding Interest

One of the most important things to understand with saving is the relationship between time and compounding interest. In other words, invest a small amount and watch it increase, exponentially, over time. Year over year, the investment steadily gains, even without a lot of additional money. The key is the earlier you start, the better it is. It is as simple as that. The sooner you start to invest your money, the more you’ll benefit from compound interest. Starting to save early means you don’t have to put away as much over time and even a few years can make a big difference.

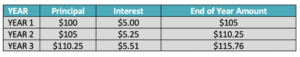

Suppose you deposited $100 with a bank for five years at a rate of 5% per year, compounded annually. The interest for the first year will be computed on $100 and you will have $105 at the end of the first year (the original amount you deposited + $5 interest). Take a look at the table below to see the amount increase over time.

Retirement Accounts

The two most beneficial options for saving are either a 401k, which we have with Goodwill, or a Roth account. Let’s apply this to a short story so you can see just how important retirement accounts, and time, can be:

Angela and Mark’s Retirement

Angela puts $200 per month into a retirement account at 25 years old. Mark starts saving $200 per month at 35 years old, just 10 years after Angela. Assuming a 6% rate of return, they both continue to add $200 each month until they retire at 65. By the time they are 65, Angela has contributed $96,000 while Mark has contributed $72,000. Angela has put in slightly more over those 10 years. However, by the time they are both ready to retire, Angela has almost twice as much as Mark — Angela has $402,492 and Mark has $203,118!

Get Started, NOW

Almost anyone can invest a small portion of their paycheck and every bit counts. Don’t think, “I need to wait until I have extra money.” Remember, the longer you wait to plan and save for retirement, the more you’ll need to invest each month. While it may be easier to enjoy your 20’s with your full income at your disposal, it will be harder to put enough money away each month to catch up as you get older. Additionally, if you wait too long, you may even need to postpone your retirement. Even if you save only 1% to 5% of your paycheck, it makes a difference.

The simplest way to start is by signing up for our 401k. If you leave the company, that account will always be yours and you can roll it over into the next company if they offer a 401k. There are more specifics on the gazette at https://goodwill.ebenefitguide.com/p13. You can also sign up in Workday by clicking the Benefits application and then clicking on Retirement Savings.

Now that I’m closer to the end of my career than the beginning, saving for retirement has become top of mind for me. If I only knew then what I know now – I would have put small amounts away earlier in life, taking advantage of time and compound interest.